Posted By Mayor Kyle Hanson on May 20, 2025

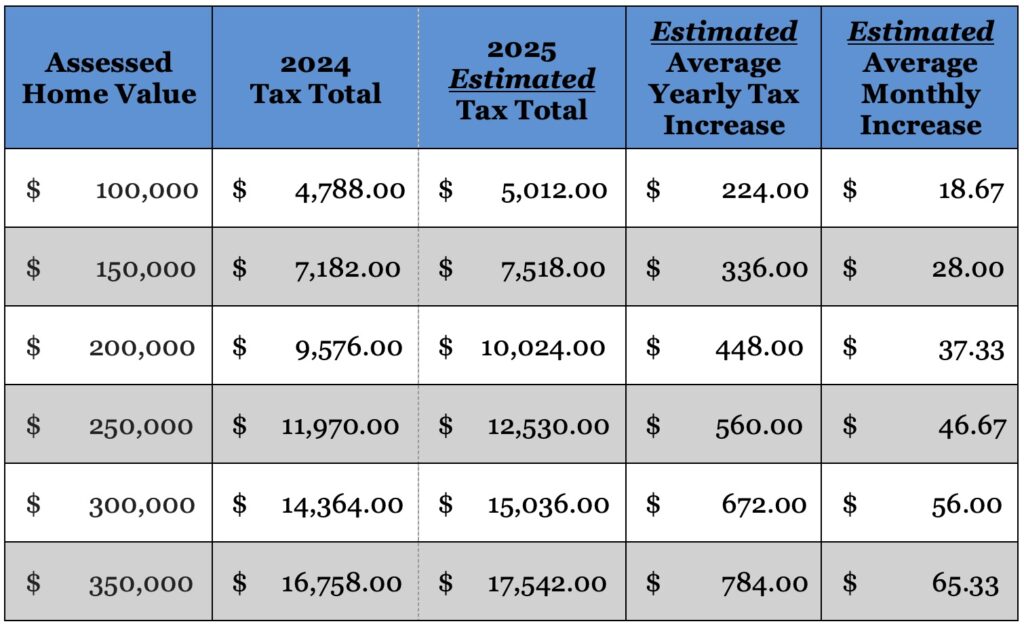

Tax Bill Breakdown by Percentage

Below is a breakdown of your 2025 tax bill by percentage, showing where your tax dollars are going…

- 52.2% of your taxes are paid by the Borough to our local school district to fund Barrington’s public schools.

- 28.1% of your tax dollars are retained by the Borough and used to provide essential services from Police, Fire, EMS, and Public Works. The Borough maintains the parks, roads, sports complexes, etc.

- 19.7% of your tax dollars are paid to Camden County which are used to help with the upkeep of County Roads (Clements Bridge Road, Gloucester Pike, etc…), County sponsored programs/events and much more.

Your Municipal Tax Dollars at Work

According to the 2020 U.S. Census, Barrington is home to 7,075 residents. Using that population figure, we’ve calculated the average weekly cost per resident for the services provided by the Borough—funded through the 28.6% portion of your tax bill that remains with us.

- average weekly cost per resident for 24-hour police coverage – $5.15

- average weekly cost for Fire service – $0.51

- average weekly cost for 24-hour EMS service – $1.21

- average weekly cost for trash & recycling collection – $1.94

- average weekly cost for Public Works Dept. (i.e. upkeep of roads, parks, ball fields, brush pick up, building maintenance, etc…) – $2.95

- average weekly cost for town events, parades and senior services – $0.13

- total weekly cost for all of the services above – $11.90

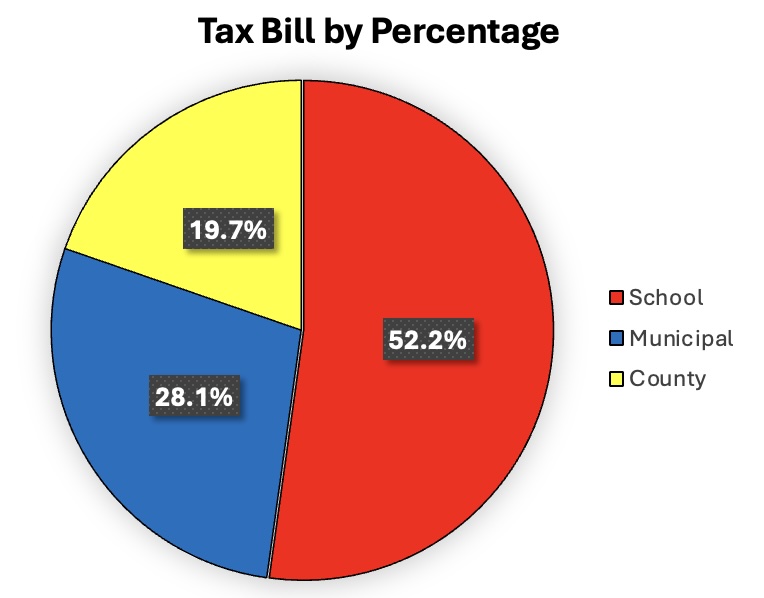

Average Monthly Tax Increase Breakdown

This year presented significant budget challenges, particularly for our school district, which experienced a reduction of over $100,000 in state aid. In response, the Board of Education has submitted a request to the State Department of Education for a one-time tax levy increase to help mitigate the impact of these cuts. If approved, the school budget tax levy would rise by more than $1.1 million this year.

I’d like to clarify that the Borough governing body is only responsible for the municipal budget. The school budget is developed and approved by the Board of Education, while the County Commissioners are in charge of determining the county budget.

The Borough’s budget committee, CFO, and all department heads worked diligently to ensure that your municipal tax dollars are being spent as responsibly and efficiently as possible. Our municipal budget faced unavoidable increases of more than $170,000 due to rising insurance and pension costs. Despite these challenges, our team carefully reviewed the budget line by line, making thoughtful cuts wherever possible across all departments.

As a result, this year’s municipal budget will include a modest tax increase—amounting to less than $82 annually for the average home—while continuing to provide essential services and support to our community.

Below is a chart that illustrates what your total average monthly tax increase will be based on your home’s assessed value. For your reference, the average Barrington home is assessed at $194,600.

For the average home in Barrington, this translates to an estimated total tax increase of $435.90. Of that amount, approximately $82 is attributed to the municipal budget, around $325 comes from the school board’s budget, and about $29 reflects the estimated increase from the county.

*Please note that values shown in this chart are averages and are not exactly what will be represented on your tax bill*